In today’s global digital economy, earning money online has become easier than ever — but receiving payments across borders remains a challenge. Whether you’re a freelancer working with U.S.-based clients, an e-commerce seller or affiliate receiving payouts from Amazon or Shopify, or a remote employee earning in USD, you’ve probably faced one common question:

How can I receive money from the U.S. directly into my local bank account without incurring significant fees and unfavorable exchange rates?

That’s where platforms like Wise and Payoneer come in. Both allow users outside the United States to get paid in USD using U.S. bank account details, then easily convert and withdraw those funds to their local bank accounts. But while they share a similar purpose, their approach, fees, and flexibility differ significantly.

In this comparison, we’ll break down Wise vs Payoneer to help you decide which platform fits your needs best. We’ll explore how each handles U.S. receiving accounts, conversion fees, transfer times, and local withdrawals — so you can choose the best one that maximizes your earnings and minimizes unnecessary costs.

TL;DR

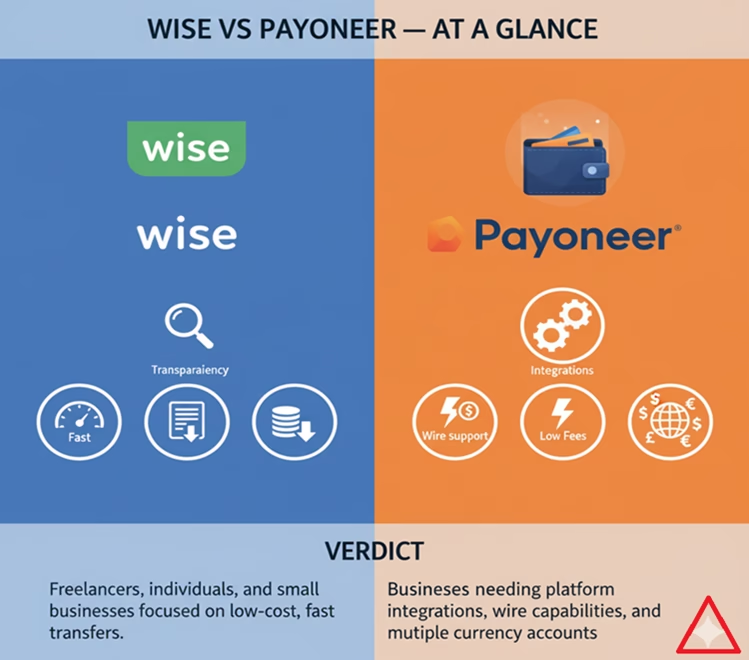

Both Wise and Payoneer let you receive USD payments using U.S. bank account details and withdraw them to your local bank. Wise offers lower fees, transparent exchange rates, and faster transfers — ideal for freelancers, affiliate marketers, and individuals. Payoneer, on the other hand, supports more marketplace integrations and is better suited for business users or frequent payouts. Your best choice depends on whether you value lower costs (Wise) or broader platform compatibility (Payoneer).

My case: Previously, I used Payoneer for receiving affiliate commissions from Amazon. But recently, I shifted to Wise because of lower fees.

How does receiving USD via a U.S. bank account work?

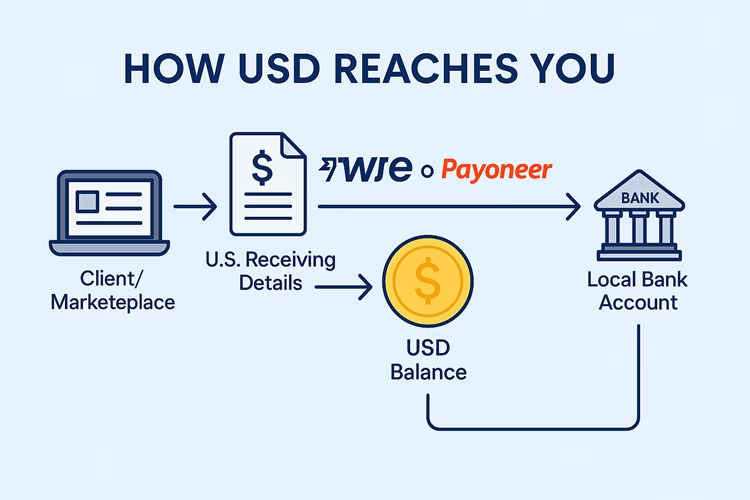

If you live outside the U.S. but earn in USD, many payment platforms need a U.S. bank account — without actually opening a physical U.S. bank account. Here’s the simple flow:

Open a U.S. receiving account. Services like Wise and Payoneer provide local-looking U.S. bank details (routing + account numbers). You can open a bank account with them for free. Payers (clients, marketplaces) send USD to the account via ACH or a domestic U.S. transfer.

Funds land in your multi-currency balance. The platform receives the USD on your behalf and credits it to your account balance. This keeps the money in USD until you withdraw it (via Wise) or it is withdrawn automatically for you (via Payoneer).

Convert or hold. You can either keep USD in the multi-currency wallet or convert it to your local currency using the platform’s exchange rate. Conversion may include a small margin above the mid-market FX rate.

Withdraw to your local bank. When you request a withdrawal, the provider sends the funds to your local bank using local rails (e.g., local ACH, Faster Payments) or international rails (SWIFT). Withdrawal times and fees vary depending on the provider and your country of residence.

Key things to check: When considering payment options, it is important to verify if the receiving details are valid U.S. routing and account numbers. You should also confirm which types of incoming payments are accepted, such as ACH or wire transfers. Be aware of any Know Your Customer (KYC) or verification requirements, as well as the limits on transfers per transaction and monthly. Additionally, take note of the provider’s conversion fees and transfer times. These technical differences can significantly impact costs, speed, and the marketplaces that will accept your receiving information.

Wise vs Payoneer: Feature-by-Feature Comparison

When deciding between Wise and Payoneer for receiving your online earnings in USD, it’s important to compare them as they differ in how they handle fees, conversions, integrations, and accessibility. Let me break it down.

1. Receiving USD (U.S. Bank Details)

Both Wise and Payoneer allow non-U.S. users to receive USD as if they had a U.S. bank account.

- Wise provides local account details (routing and account number) available for most supported countries. Payments can be received via ACH transfers, making it ideal for clients or companies that pay domestically within the U.S. However, Wise doesn’t support wire transfers (SWIFT) to the U.S. account, which limits certain types of payments.

- Payoneer offers Global Payment Service accounts in multiple currencies, including USD, EUR, GBP, and more. The USD account supports both ACH and wire transfers, giving it broader compatibility. This makes Payoneer especially useful for those getting paid from platforms or clients that use wire transfers or U.S. corporate accounts.

✅ Verdict: Payoneer offers more flexibility for receiving USD payments, while Wise is perfect for straightforward ACH payments from U.S.-based clients.

2. Fees & Exchange Rates

Fees are where Wise often shines.

- Wise uses the mid-market exchange rate (the same rate you’d see on Google) and charges a small, transparent transfer fee. There are no hidden margins, and you always see the full breakdown before confirming the conversion.

- Payoneer, on the other hand, typically adds a conversion margin of 2–3% above the mid-market rate, plus possible withdrawal fees depending on the destination country. For receiving funds, Payoneer doesn’t charge a fee from certain sources (like Upwork), but some payments — especially those made via credit card or direct bank transfers — can incur fees.

✅ Verdict: Wise is cheaper and more transparent for currency conversion and withdrawals. Payoneer may charge up to $29.95/year if your account remains inactive.

3. Transfer Speed & Reliability

- Wise transfers are generally fast. Once USD hits your Wise account, conversions and withdrawals to your local bank often complete within a few hours to one business day, depending on the country.

- Payoneer transfers typically take 1–3 business days to reach your local bank after withdrawal. The platform also occasionally holds new accounts or large payments for compliance verification, which can delay access to funds.

✅ Verdict: Wise offers faster and more predictable transfer times.

4. Verification & Onboarding

Both platforms require identity verification (government ID, proof of address, and sometimes proof of income or business activity).

- Wise has a straightforward, automated KYC process that usually completes in a few hours.

- Payoneer’s verification can take longer, especially for business accounts, as they often request additional documents.

✅ Verdict: Wise’s onboarding is quicker for individuals, while Payoneer’s process is better suited for registered businesses.

5. Payout Integrations & Marketplace Support

Here’s where Payoneer dominates.

It’s directly integrated with major freelance and e-commerce platforms like Upwork, Fiverr, Amazon, Airbnb, and 2Checkout, allowing automatic payouts to your Payoneer account. Wise currently lacks such direct integrations, requiring manual transfers from clients or linked bank accounts.

✅ Verdict: Payoneer wins for freelancers and sellers using global marketplaces. As I am currently using Wise, it supports Amazon and other marketplaces.

6. Supported Countries & Local Withdrawals

Both Wise and Payoneer support withdrawals to 100+ countries. Wise connects to more local banking networks, offering cheaper withdrawals in countries like India, the Philippines, Nigeria, and across Europe. Payoneer supports global withdrawals, but often via SWIFT, which can add extra charges.

✅ Verdict: Wise offers more affordable and local-friendly withdrawal options.

7. Customer Support & User Experience

- Wise provides excellent transparency, an intuitive dashboard, and responsive live chat support.

- Payoneer has more complex support channels and sometimes slower response times, though it offers phone support for verified users.

✅ Verdict: Wise wins for usability and customer experience.

Overall Comparison Summary

| Feature | Wise | Payoneer | Best For |

|---|---|---|---|

| U.S. Receiving Account | ACH only | ACH + Wire | Payoneer |

| Exchange Rates | Mid-market | 2–3% markup | Wise |

| Fees Transparency | Very clear | Mixed | Wise |

| Transfer Speed | 0–1 day | 1–3 days | Wise |

| Marketplace Integration | Limited | Extensive | Payoneer |

| Local Withdrawals | Wide coverage | Global, mostly SWIFT | Wise |

| Verification Speed | Fast | Slower | Wise |

| Best For | Freelancers, affiliates, Individuals | Marketplaces, Businesses | Depends on use case |

Real-World Scenarios & Recommendations

Scenario 1: Freelancers Receiving Payments from U.S. Clients

If you’re a freelancer working directly with U.S. clients on platforms like Upwork, Fiverr, or via direct contracts, your main priorities are low fees and fast withdrawals.

Recommendation: Wise is the better option here. It gives you real U.S. bank details for ACH transfers, transparent mid-market rates, and quick deposits to your local bank — ideal for individual freelancers and small payments.

Scenario 2: E-commerce Sellers or Affiliate Marketers Getting Paid in USD

If you sell on Amazon, Shopify, or other global marketplaces, you need a platform that supports marketplace payouts and multiple currencies.

Recommendation: Payoneer is the smarter choice. Its direct integrations with Amazon, Walmart, and other e-commerce platforms make it easier to receive payments automatically in USD, EUR, or GBP, then withdraw them to your local account. However, you can use Wise for small and infrequent payouts at lower fees.

Scenario 3: Small Businesses Managing Global Client Payments

For small businesses or agencies that handle multiple international clients, you’ll want flexible receiving options, mass payouts, and business tools.

Recommendation: Payoneer fits best. It supports both ACH and wire transfers, allows invoice generation, and offers mass payout features — ideal for scaling operations globally. However, if your focus is on minimizing conversion fees, consider using Wise.

How to Set Up & Use Each Platform (Step-by-Step Guides)

Setting up Wise and Payoneer to receive your online earnings is simple, but each platform has slightly different steps and verification requirements. Follow these step-by-step guides to get started quickly and avoid common setup issues.

How to Set Up and Use Wise

Step 1: Sign Up for Wise

- Go to the Wise platform and sign up using your email address.

- Choose between a Personal or Business account. If you want to use it mostly for fund transfer, choose Personal. But businesses and registered companies should choose Business.

Step 2: Verify Your Identity

- Use your government-issued ID (passport, driver’s license, or national ID).

- Fill in your local bank details.

- Wise conducts a video verification process.

- Verification usually completes within a few hours.

Step 3: Open a USD Receiving Account

- Once verified, go to “Balances” → “Open a balance” → “USD.”

- Wise will generate U.S. bank details (account number and routing number).

- These details allow you to receive ACH transfers in USD — just like a U.S. resident.

Step 4: Share Your Bank Details

- Share these details with your clients or platforms (for example, Amazon) that pay via U.S. ACH transfers.

- Make sure your payers use ACH, as Wise currently does not support incoming wire transfers for USD.

Step 5: Hold, Convert, or Withdraw

- You can hold USD in your Wise balance or convert it to your local currency anytime.

- Withdraw funds to your local bank account using local transfer rails.

Step 6: Optional — Get a Wise Debit Card

Order a Wise debit card (if available in your country) to spend directly from your multi-currency balance worldwide.

✅ Tip: Use Wise’s built-in calculator before every transfer to see exactly how much you’ll receive after conversion — no hidden fees.

How to Set Up and Use Payoneer

Step 1: Sign Up for Payoneer

- Visit payoneer.com and click “Sign Up.”

- Choose your account type — Individual or Company.

- Fill in your personal details, including your local bank account (for withdrawals).

Step 2: Verify Your Account

- Payoneer requires identity verification, proof of address, and sometimes business verification documents (if applicable).

- This process can take 1–3 business days.

Step 3: Activate Global Payment Service (U.S. Account)

- Once verified, go to “Receive” → “Global Payment Service.”

- You’ll find U.S. bank details (account number, routing number, and bank name).

- These details support ACH and wire transfers, making it ideal for U.S. clients, marketplaces, and affiliate networks.

Step 4: Add Receiving Account to Marketplaces

- Link your Payoneer account to supported platforms such as Upwork, Fiverr, Amazon, Airbnb, or ClickBank.

- Payouts will automatically deposit into your Payoneer USD balance.

Step 5: Convert or Withdraw Earnings

- Choose to hold USD, convert to another currency, or withdraw to your local bank.

- Withdrawals usually take 1–3 business days, depending on your location and bank.

Step 6: Optional — Payoneer Prepaid Card

You can apply for a Payoneer MasterCard, which lets you spend your funds directly online or at ATMs.

✅ Tip: Payoneer charges higher conversion margins, so it’s smart to compare rates before converting large USD balances.

Pros and Cons

After comparing Wise and Payoneer across features like fees, speed, and integrations, here’s a clear breakdown of each platform’s key advantages and disadvantages to help you decide which one fits your online earning needs best.

Wise (formerly TransferWise)

Pros

- Transparent Fees: Uses the real mid-market exchange rate with a small, clearly shown fee — no hidden markups.

- Fast Transfers: Local withdrawals are often completed within hours or the same day.

- Low Conversion Costs: Ideal for freelancers, affiliate marketers, and remote workers.

- Simple User Experience: Clean dashboard, real-time tracking, and easy-to-understand pricing.

- Multi-Currency Support: Hold and convert between 40+ currencies effortlessly.

- Local Bank Withdrawals: Offers direct transfers to many countries’ local banking networks, reducing SWIFT charges.

Cons

- No USD Wire Transfer Support: Only supports ACH transfers for USD — not ideal for clients using wire payments.

- Limited Marketplace Integrations: Some marketplaces may not support Wise.

- No Mass Payout Feature: Lacks tools for managing large-scale or recurring business payments.

✅ Best For: Freelancers, consultants, and remote workers who want low-cost USD-to-local transfers with full fee transparency.

Payoneer

Pros

- Supports ACH and Wire Transfers: Allows you to receive USD payments from almost any U.S. client or company.

- Marketplace Integrations: Seamlessly connects with Upwork, Fiverr, Amazon, Airbnb, and many others, enabling automatic payouts.

- Global Payment Service: Lets you receive payments in multiple currencies (USD, EUR, GBP, etc.) using local bank details.

- Prepaid MasterCard Option: Spend funds directly online or withdraw from ATMs worldwide.

Cons

- Higher Conversion Fees: Currency conversions typically include a 2–3% margin above the mid-market rate.

- Longer Transfer Times: 1–3 business days.

- Complex Fee Structure: Some incoming payments, card transactions, or withdrawals may incur hidden or variable fees.

✅ Best For: Freelancers and businesses receiving payments from marketplaces, U.S. companies, or multiple currencies who need wide payout compatibility.

At a Glance: Which One Should You Choose?

| Category | Best Choice |

|---|---|

| Lowest Fees | Wise |

| Marketplace Compatibility | Payoneer |

| Fast Withdrawals | Wise |

| Receiving USD via Wire | Payoneer |

| Transparency & Ease of Use | Wise |

| Business & Bulk Payments | Payoneer |

Frequently Asked Questions (FAQs)

1. Do Wise and Payoneer give you a real U.S. bank account?

Not exactly — both provide virtual U.S. receiving accounts. Wise gives you ACH bank details (routing and account number) through its USD balance, while Payoneer provides a U.S. receiving account that supports both ACH and wire transfers. These accounts function like real U.S. accounts for receiving payments but are issued by partner banks.

2. Can I receive payments from U.S. clients directly to my Wise or Payoneer account?

Yes. Both platforms allow you to receive USD payments from U.S. clients. Wise supports ACH transfers, while Payoneer supports both ACH and wire transfers, giving it a wider range of compatibility with U.S. payers.

3. Which platform has lower fees for currency conversion?

Wise has the clear advantage. It uses the mid-market exchange rate with a small, transparent fee, while Payoneer typically adds a 2–3% markup on top of the market rate when converting currencies.

4. How fast can I withdraw funds to my local bank account?

Wise withdrawals usually take a few hours to one business day, depending on your country.

Payoneer withdrawals take 1–3 business days, though marketplace payouts may take longer if under review.

5. Can I connect Wise or Payoneer to platforms like Upwork, Fiverr, or Amazon?

Only Payoneer offers direct integrations with platforms like Upwork, Fiverr, Amazon, and Airbnb.

Wise doesn’t have direct integration; you’ll need to manually add your Wise account details to receive client transfers.

6. Are there any limits on how much I can receive or withdraw?

Yes.

Wise has flexible limits based on country and verification status, typically allowing up to $1 million USD per transfer for verified users.

Payoneer also allows large transfers but may hold new or high-value payments for compliance review.

7. Which is better for freelancers — Wise or Payoneer?

For freelancers with direct U.S. clients, Wise is better due to lower fees and faster withdrawals.

For freelancers using platforms like Upwork or Fiverr, Payoneer is better because of its direct payout integrations.

8. Is it safe to receive and store money in Wise or Payoneer?

Yes, both are regulated financial institutions:

- Wise is authorized by the UK’s Financial Conduct Authority (FCA) and other global regulators.

- Payoneer is licensed by the U.S. Department of the Treasury (FinCEN) and operates under strict compliance standards.

- Your funds are held in safeguarded accounts, separate from company operations.

Guides for Online Money Makers

Written and edited by: Ibochouba Singh

Dated: November 11, 2025

Disclosure: We are partners or associates of Amazon and other top brands. We may earn a small amount from qualifying purchases without increasing the price. Please read our full affiliate disclosure here.

Ibochouba Singh is a content writer and reviewer with a passion for writing about digital marketing and tech gadgets, including software tools and new tech gadgets. He has over 15 years of experience writing for several consumers and clients, including tech startups, marketing agencies, and software companies. He has written many articles and product reviews for many websites, including nigcworld.com and buywin.in.